MoneyPlace

The leading unsecured personal loan provider on the market with rates starting as low as 6.45%.MoneyPlace

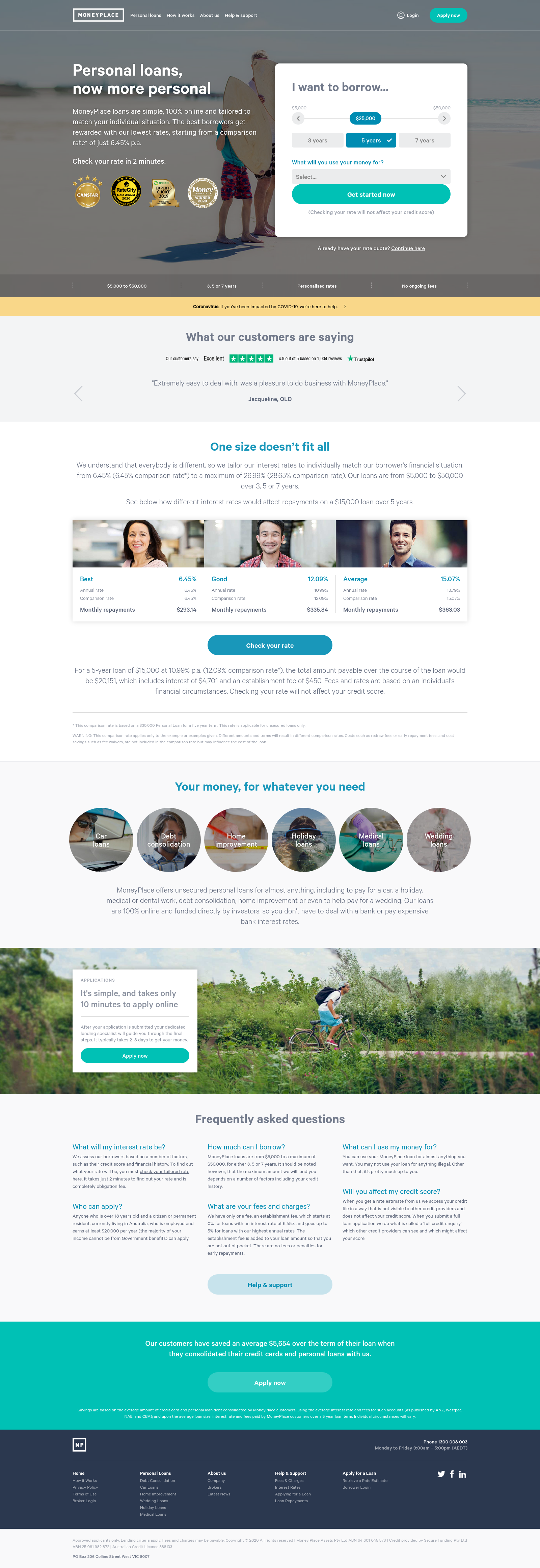

MoneyPlace is a fast-growing consumer lender providing personal loans from $5K-50K. With no monthly fees or exit costs, fast turnaround times, and great interest rates from 6.45%, we provide fairer, better rates for borrowers. MoneyPlace has won awards from Money Magazine, Canstar, Mozo, and RateCity for our personal loans, and our customers are extremely satisfied, with market-leading TrustPilot and Google reviews. Get a rate estimate in 1-2 minutes and submit a full application in 10 minutes. Our hyper-efficient lending platform means MoneyPlace borrowers receive funds as quickly as one hour.

Images

Blog Posts

20th August, 2019

Ice ice baby: essential tips for an epic winter road trip

By Josh Sale, Canstar If you’re on social media this winter, chances are you’re being berated by pic...

20th August, 2019

Emergency! Why half of us couldn’t survive a month without a job

What happens if you lose your job? If you’re like most of us, the mere thought probably induces a wh...

31st July, 2019

When is a credit score not the ‘right’ credit score?

Credit scores are becoming increasingly relevant to Aussies looking to get loans of any kind. The re...

30th July, 2019

Buy now, huge debt later?

Is it a smart budgeting move to pay in instalments? Or the beginning of a spiral (send help!)? Or is...

17th June, 2019

Lessons from Australia’s three comma club

Australia’s richest 200 people according to the Australian FInancial Review are worth $341.8 billion...

17th June, 2019

Free doughnuts! And other hacks from the internet’s best savers

There are two kinds of people that will read this article. You’ve either heard of OzBargain, or you ...

17th June, 2019

Why you probably don’t need a tax accountant

What’s worse? The idea of sitting at your computer for hours doing tax, or forking over hundreds to ...

17th June, 2019

From big spender to debt free: a $15,500 transformation

For a compulsive spender, reality can be an expensive awakening. In the case of Nataasha Torzsa, her...

17th April, 2019

Fancy some DIY this long weekend? STOP

Put down the toolkit buddy, and keep your Bunnings receipts. Despite what reality TV suggests, somet...

17th April, 2019

How much would you pay for this Easter Egg?

Should we spend more than $100 on one Easter Egg? Um no. Of course not. Chocolate is, after all, jus...