Credit Clear

The market leader in digital actionable communications for optimising receivablesCredit Clear

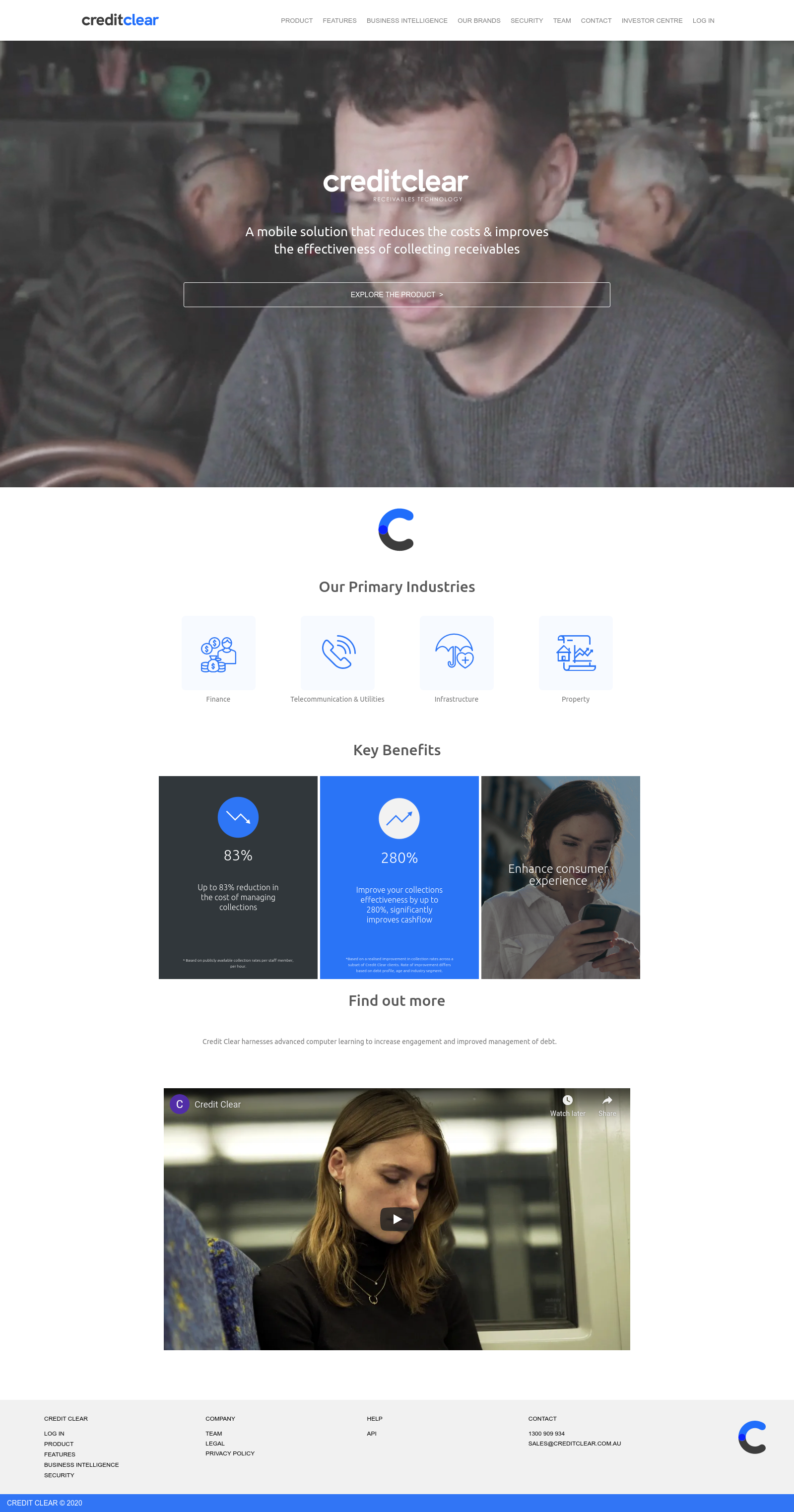

Credit Clear is an Australian-based financial technology (FinTech) company that specialises in providing an innovative and proven solution for enterprises to significantly improve their effectiveness in collecting payments while also greatly reducing their associated costs. With a continually growing list of many significant clients, Credit Clear’s proven track record is impressive. As an example, one client in the collections space has shown a 78% improvement to their previous collection rate combined with an 83% reduction in resource costs. The secret to Credit Clear’s success lays in its origins. Credit Clear was born from the frustrations of Credit Clear’s founder, Lewis Romano, in attempting to pay his own outstanding bills as a customer. He experienced the process as difficult, inconvenient and highly unpleasant. With the thought that ‘there must be a better way’, the genesis of Credit Clear was born. Credit Clear provides a customer-centric solution to collecting outstanding bills that is highly customer-friendly on two predominant fronts: 1) Credit Clear’s proprietary customer-intelligence based system for tailored messaging that speaks to the customer’s values, and 2) Credit Clear’s use of the latest technology to remove barriers (physical and psychological) for the customer to instantly pay their accounts through actionable mobile messages. Credit Clear’s solution is nothing short of revolutionary in the payments collection industry. Traditional ‘missed payments’ recovery methods have generally delivered an indifferent experience for consumers coupled with a high cost of recovery for businesses. In contrast, Credit Clear’s secure, smart payment arrangement system provides businesses with a ground-breaking ‘payments collection’ platform that is customer-centric and selects the most appropriate communication methods based on the profile of the customer while using everyday mobile channels such as email and text messaging.