QuietGrowth

Wise investing for all.QuietGrowth

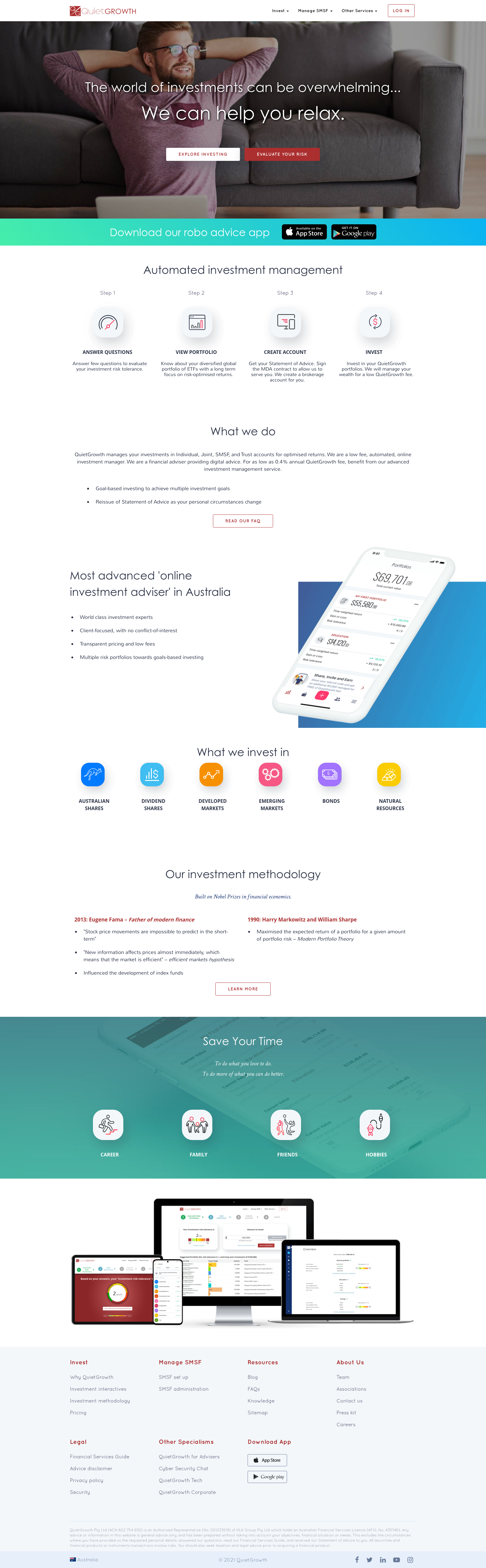

QuietGrowth is a digital investment management service or robo advisor. We manage the investments of clients to achieve risk-optimised returns over the long-term. QuietGrowth provides personalised investment advice to the client and manages the funds that the firm invests on behalf of the client. We offer customised and diversified portfolios to the client. We support Individual, Joint, SMSF, and Trust account types. Our highly-skilled investment experts and engineering teams have built a robo advice solution that automates the delivery of our service. Our solution uses algorithms and interactive interfaces to provide a high-quality service. We are the most advanced online investment adviser in Australia.

Images

Blog Posts

16th October, 2023

An introduction to the appeal of Australian Government Bonds

Australian Government Bonds (AGBs), or Australian treasuries, are debt securities issued by the Aust...

12th October, 2023

An introduction to bond ratings

Bond ratings are a measure of the creditworthiness of a bond issuer. They give investors an idea of ...

9th October, 2023

Introduction to bond maturity period

An essential aspect to understand about bonds is their maturity period. The bond’s maturity period c...

6th October, 2023

Conventionalisation of the new term ‘robo adviser’

One popular term that has emerged since 2010 from the increasing adoption of automation in the finan...

27th September, 2023

An introduction to Total Return Bond ETF

A Total Return Bond ETF is an exchange-traded fund that invests in a diversified set of bonds, seeki...

20th September, 2023

Impact of rising interest rates on a bond ETF

Bond ETFs (Exchange-Traded Funds) are versatile investment vehicles, and for good reason. Diversifie...

19th September, 2023

Difference between a standalone robo adviser and independent robo adviser

All independent robo advisors are standalone, but not all standalone robo advisors are independent. ...

2nd June, 2023

An introduction to Random Walk Hypothesis

One of the most significant discussions in finance and economics is about the predictability of stoc...

31st May, 2023

An introduction to Efficient Market Hypothesis (EMH)

The Efficient Market Hypothesis (EMH) is a financial theory that posits that financial markets are “...

29th May, 2023

Common questions about Modern Portfolio Theory (MPT)

We hope to provide a clearer understanding of Modern Portfolio Theory by answering common questions....